Here’s an older spreadsheet to help you model various big and small home maintenance expenses. Boilers boil over and shingles blow away. This is a PDF, not a spreadsheet, unfortunately, but it would be easy to port over to Excel or Google Sheets. Use this worksheet from Allstate to keep track of and estimate the extra fees that go along with buying a house.

HOUSE BUDGET EXAMPLE FREE

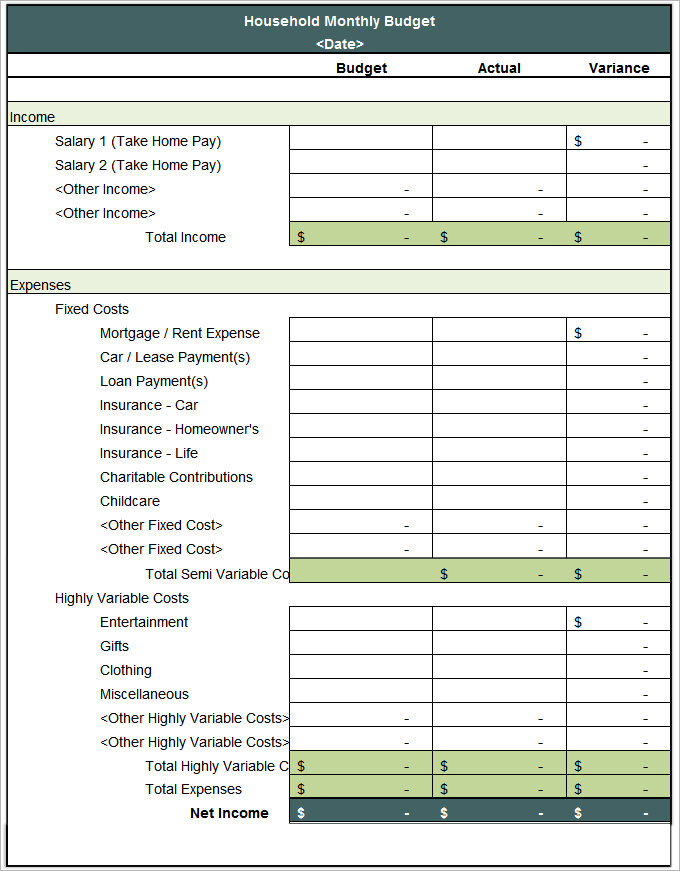

These can easily be modified to track multiple savings goals.īecause it’s powered by Tiller Money Feeds, it’s the only template on this list that automatically keeps your budgets and savings goals updated with your actual spending and account balances.įor even more control of tracking savings goals, add the free Savings and Debt sheet to your Foundation Template from Tiller Community Solutions. Tiller’s Foundation Template for Google Sheets includes a yearly and monthly budget. Tiller Foundation Budget + Savings Budget What are the other considerations to be made during the process?Īnd here’s another example of a Buy A House Or Rent spreadsheet.What is the potential tax-savings of being a homeowner?.The creator of this spreadsheet on Reddit used it to decide if they should rent or buy – in San Francisco, one of the most expensive cities in the US.

Get the Google Sheet Template House Buying Model vs Renting Spreadsheet It also helps you make a quick personal budget that includes house maintenance, taxes, and the mortgage itself.

Here’s a simple but effective spreadsheet from Reddit to help you experiment with different home purchase price scenarios for buying a home. This can then be opened in Google Sheets or Microsoft Excel for further manipulation and analysis.

HOUSE BUDGET EXAMPLE DOWNLOAD

Once you input your data points, you can download the worksheet as an Excel file. This is a useful and trusted web-based calculator for getting started with thinking about your home buying finances. This also discusses managing your debt-to-income ratio to help you get qualified for a better mortgage.

This article provides standard rule-of-thumb numbers for how much you should budget for your down payment, closing costs, etc. If you want to make your own budget for planning a home purchase, here are some helpful tips to start with from Investopedia. Then, there’s tracking and optimizing your savings for a down payment, closing fees, and moving.įinally, when you own a home, your expenses will change – very often for the better! Housing expenses (property tax, insurance, pmi, hoa, etc).Available funds for down payment and closing costs.What should be in your budget for buying a house?īudgeting to buy a house involves several stages.įirst, there’s learning what you can afford. So here are several free spreadsheets to help you see what you can afford, save up for a downpayment, and budget for the ongoing expenses (and tax benefits) of homeownership. That’s especially true now, with housing prices increasing rapidly across the United States. Planning a home purchase requires more thought and consideration than ever. Saving up to buy a home was at the top of the list for many people.įor most people, buying a house is one of the biggest and most impactful decisions of their financial lives. In a recent thread, Tiller Community members shared their financial goals for the year ahead.

0 kommentar(er)

0 kommentar(er)